By Daniel Obagha

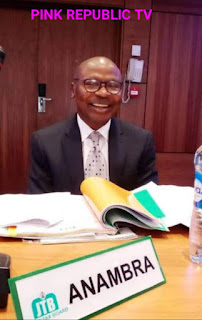

The Acting Director and Head of Department (HOD), Direct assessment tax at Anambra State Internal Revenue Service (AIRS), Mr Herbert Ofomata, has urged people living in the state to always pay their tax to support the development plans of Gov. Chukwuma Soludo.

Ofomata made this call while speaking with news men in his office at AIRS headquarters, Revenue House, Awka.

‘‘Tax is the revenue that the government is using to construct roads, build schools and provide social amenities. Every community in Anambra State gets 20 million Naira every year in what is called choose your project initiative to make sure that everybody benefits from the tax .

‘‘Look at the huge amount our Governor, Soludo, spent in providing security for all the people living in Anambra. He has hired 5000 teachers within his 100 days in office. Look at the renovations that are going on in various hospitals in the state. So we are appealing to Ndi Anambra to support him by paying their tax as at when due.

"Whatever you are doing, no matter how small, go to any tax office and tell them to do assessment for you and you will pay your tax," Ofomata appealed .

The head of assessment said that payment of tax is a civic duty and that anybody that is doing anything that gives him or her money should pay tax.

‘‘Tax is the first and foremost source of revenue to government before we started discovering mineral resources, agricultural produce, others. Just like no human being can survive without blood flowing in them so is tax the life wire of any country or government.

"No country or government can survive without tax. So everybody that is earning income is expected to pay their tax.

‘‘There is what we call meaningful economic activities. Whatever you are doing that translates to economic activities that helps you to earn money, there is tax element in it. If you are a salary earner, there is tax in it. If you are a business man if you make gain or income there is tax in it,’’ he said.

The acting director said that whenever someone makes gain in their business, he/she should check part of the income that should go to government. It is your duty to go and pay it in any tax office according to tax law."

Ofomata explained that tax is not a matter of gender or age.

‘‘Gender in the sense that male and female human beings pay tax. That is why you see teachers, lecturers, lawyers, commissioners who are females pay their tax. If they work for government they will be deducting their taxes from their salaries. The same way market traders, men and women, subsistent farmers in the agrarian communities including cattle rearers should pay their taxes."

The tax man noted that tax do not know age. That a baby born yesterday could pay their tax if they earned income. Because tax is a question of income.

‘‘Let me give you an example. You know the late MKO Abiola. Assuming one of his wives gave birth to a baby boy, after the jubilation, he will call his lawyer and say you know that my estate in Anambra State, I have given it to this my new born baby boy. Then the lawyer will add it. So, if there is income from that estate, the person holding the estate in trust for the new born baby will pay tax from it. So invariably, the baby boy is paying tax."

The HOD said that income earners are given between January and March every year to go to any tax office and pay their tax. That after the grace of the three months, tax collectors could come to collect the tax themselves.

‘‘So from first April, if you have not paid your tax then government can come to your shop or office and say you have not paid your tax now that we are here pay your tax. And whenever you are paying the tax you should pay it with penalty because you did not come when you were supposed to come.’’, he said.

The head of assessment explained that there were approved list of tax paid to federal, state or local government.

‘‘There are some taxes that federal government collects like petroleum income tax and company income tax. Then state government collects pay as you earn tax. That is tax paid by all the people that are working in Anambra State like civil servants, workers in the bank etc. For local governments they collect tenements rate, marriage certificate fees, closure of roads for occasions etc."

Ofomata added that what people call double taxation is not what they take it to be. He said that double taxation is when a particular income is subjected to tax twice .

‘‘For instance, if you are earning 100,000, while working and living in Anambra and you are taxed on it, no other state in Nigeria will subject that your salary to tax again. If any one does that, then that is double taxation.

‘’But some people have shops in Anambra and Enugu and when they pay their tax in Anambra if they go to Enugu and they are asked to pay their tax they will call it double taxation. Meanwhile they have not subjected the income they make from their shop in Enugu to tax. That one is not double taxation."

He noted that there is difference between taxes, levies and rates: ‘‘ tax is a compulsory income payable by a citizen without any direct benefit attached to it. Levies are in form of what ASWAMA is collecting for clearing rubbish in your environment. It is not tax. Just like paying for water rate or fees like drivers license . So those levies, rates and fees people pay for direct services they receive is not tax’’.

Ofomata added that a lot of jingles are going on on radios and televisions educating people on the importance of paying tax.

He mentioned some of their challenges in tax collection such as tax empathy, inadequate staff to bring all taxable people to tax net and very few vehicles for mobility. (MOI)

Comments

Post a Comment